Insurance Continuing Education Provider Number: 1015

Success CE, Inc. provides this information as a courtesy to individuals who are subject to Florida Insurance Continuing Education requirements. Our comprehensive guide provides essential insights for individuals fulfilling Florida insurance CE obligations. To ensure compliance with potential regulatory changes, we recommend contacting your state’s insurance department. While we make diligent efforts to provide accurate and current information; Success CE, Inc. nor it’s employees warrant or represent that this information presented is accurate and current. All details are subject to change without notice. Stay informed and meet Florida’s continuing education requirements by exploring the essentials of Insurance CE.

Florida Department of Insurance Contact Information

Florida Department of Financial Services

Bureau of Licensing

200 East Gaines Street

Tallahassee, FL 32399-0319

PHONE: (850) 413-3137

EMAIL: agentlicensing@myfloridacfo.com

State Website: https://www.myfloridacfo.com/division/agents/licensure/

License Status

- Find your License number

- View your CE Transcript

- Find your Florida Insurance Line of Authority

- CE Requirements Search – FL DFS

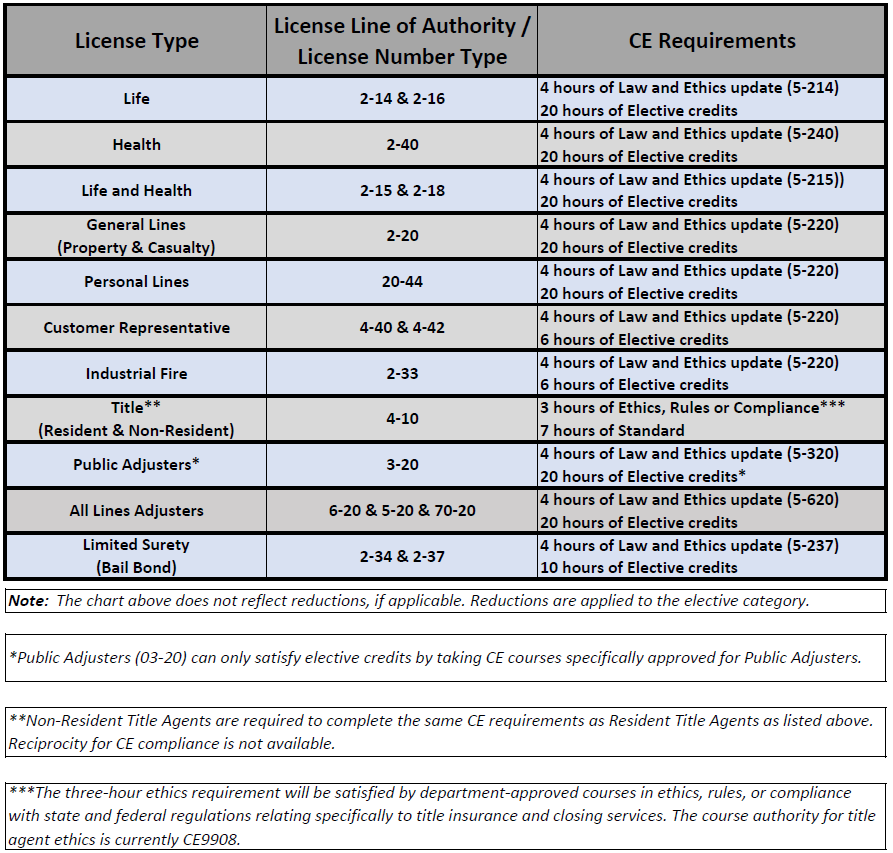

FL Insurance Continuing Education (CE) Required by License Type

For more information or to see if you qualify for an elective hour reduction, please click the link below to be directed to

Florida Statutes, Title XXXVII, Chapter 626.2815, “Continuing Education Requirements”.

Check Section (3) (b)(c)(d)(e)(i) to see if you qualify for a reduction.

Click here to view Statutes

Florida State-Specific Insurance CE Certifications

- Courses must be approved for lines of insurance for which agent is licensed

- Long-Term Care – A federal mandate and not regulated by the Florida Department of Financial Services. The LTC requirement is enforced by the Florida Office of Insurance Regulation, and the regulation of the requirement is passed down to insurer and carrier. The Long-Term Care requirement and your CE requirement are independent of one another; you do not have to complete a long-term care course to fulfill your CE requirement.

- General Lines and Customer Representative Licensees – Must complete one hour of premium discounts CE each renewal cycle. The premium discounts are based on various Hurricane Mitigation Options. Please see the Property & Casualty (General Lines) Category and select one of our two available courses to meet this requirement: Florida Hurricane Loss Mitigation (73683) OR Florida Premium Discount for Hurricane Loss Mitigation (67556).

- Flood Insurance – Florida licensed insurance agents who currently sell or may sell Flood Insurance must complete a one-time, 3-hour training course. The 3 hours are not required in addition to the normal number of credit hours required for license renewal.

New Requirement to Sell Annuities in Florida

Effective January 1, 2024: Annuity – Best Interest: Effective on January 1, 2024, The Suitability in Annuity Transactions statute now requires agents to take a 4-hour training course, specifically dealing with the types of annuity contracts and how to determine if those products are suitable for prospective clients. If a person already holds a license that allows them to sell the annuities line of insurance, they will have until July 1, 2024, to complete this required training.

On or after January 1, 2024, a new licensee will not be eligible to sell annuity contracts until this training has been completed. It is the responsibility of insurers to verify that an agent has completed the annuity training course before allowing an agent to sell an annuity product for that insurer. This requirement is not part of an agent’s continuing education requirement. However, if a course provider submits and receives approval from the Department, the course is eligible for continuing education credit.

If a licensee completed the 4-hour Annuity Training requirement before January 1, 2024, they must complete a new 4-hour training course, or an additional 1-hour training course on appropriate sales practices, replacement, and disclosure requirements, no later than July 1, 2024.

Insurance Continuing Education Renewal or Compliance Date for Licensees

- End of birth month following the second anniversary of the first license issuance date, and then biennially thereafter.

Final Exam Regulations

- Independent self study courses or classroom.

- All FL CE Final Exams are required to be taken as closed book.

- Independent self study course(s) require an exam where 70% or higher is a passing score.

- Online self study courses DO NOT require a monitor.

Reporting to Your State/Regulatory Authority

- State Insurance completions are reported 2 times every business day. If course is completed after 2 PM PT, it will be reported the following business day.

- CFP reports are sent on Friday at 2 PM PT to the CFP Board electronically.

- You may also self-report your CFP completions to www.cfp.net

Florida Insurance CE Carry-Over Hours & CE Course Repetition

- Excess CE hours accumulated during any 2 year compliance period may be carried forward to the next compliance period

- Courses may not be taken for credit more than once in a 2 year period.

Method to Certify Completion:

- The certificate of completion will be available to print or download online immediately after you have pass the final exam.

- The DOI or regulatory authority can take up to 30 days to process your new completion results on their systems.

Florida Non-Resident Producer Requirements

- Initial LTC Requirement: Non-resident producers must contact their carriers to determine any training requirements.

Florida Insurance Producer Exemptions

- Individuals that hold a limited lines license that an exam is not required.

- Individuals with any of the following limited licenses: dental representative, motor vehicle physical damage and mechanical breakdown agent and crop hail and multiple peril crop agent.

- Individuals who are officials or employed by a government entity and whose job description requires them to say current on insurance issues. Approval from the Florida Department of Financial Services is required.

The Success Family of CE Companies provides this information as a courtesy to individuals who are subject to insurance continuing education requirements. Due to regulatory requirements we suggest that you contact your state department of insurance to insure that no regulatory changes have been enacted. Although ongoing efforts have been made to qualify that the information provided here is accurate and current, neither The Success Family of CE Companies nor its employees warrant or represent that this information is accurate and current. All information is subject to change without notice.